Senator Charles Grassley Supports Need for Small Business Expense Protection Act, S 3612

The following legislative alert was sent by the National Newspaper Association on July 15, 2020.

Community newspapers that received the Paycheck Protection Program loans urgently need to have S. 3612 included in McConnell’s proposal. Sens. John Cornyn, R-Texas, and Charles Grassley, R-Iowa, are leading the way to get their bill included.

Senate Majority Leader Mitch McConnell and other Senate leaders are closing in on the Senate Republicans’ proposal for the next stimulus bill — which McConnell says will be the final one in 2020.

Community newspapers that received the Paycheck Protection Program loans urgently need to have S. 3612 included in McConnell’s proposal. Sens. John Cornyn, R-Texas, and Charles Grassley, R-Iowa, are leading the way to get their bill included. The bill has bipartisan support from Sens. Jeff Merkley, D-Oregon, Thomas Carper, D-Delaware, and Doug Jones, D-Alabama.

The bill would ensure that small businesses can continue to deduct their payroll expenses, rent, mortgage interest and utilities, even if those costs were supported by PPP loans. Without this bill, the Treasury Department intends to tax those expenses, which would effectively take away the money that Congress intended to provide in forgivable loans for small businesses.

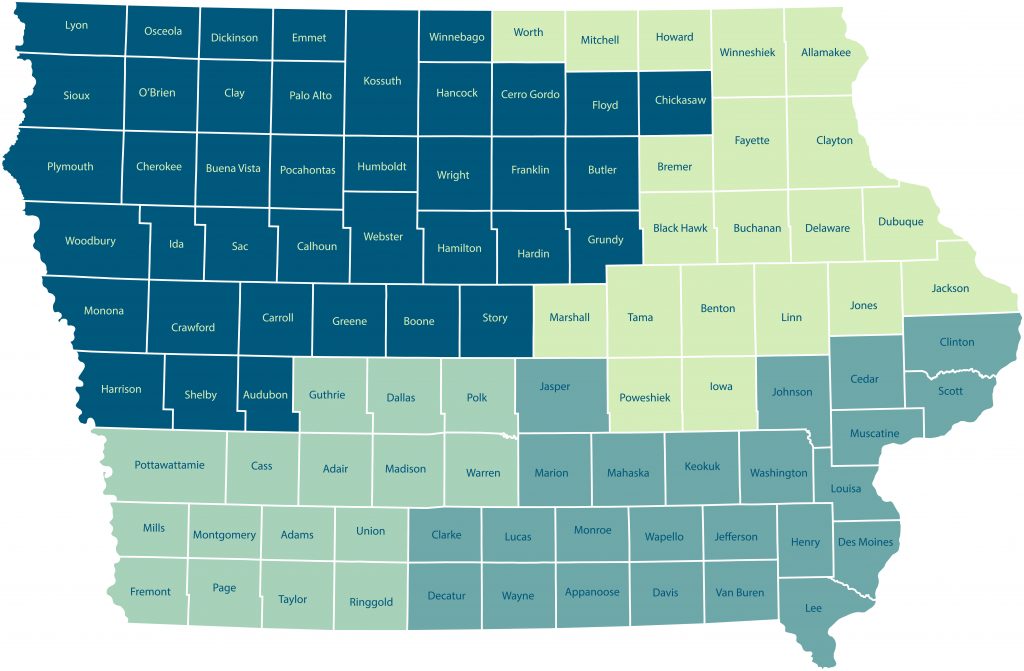

The co-sponsors are listed below. If you see your senator, please take a moment to send a short note of appreciation. If you do not, please contact his or her office asap and ask for support. All offices can be reached from www.senate.gov.

It is important for Senate offices to understand that this bill is not a request for additional stimulus funds. It is simply a correction of erroneous tax policy on the original PPP loans.